Virtual Cfo In Vancouver Fundamentals Explained

Wiki Article

Virtual Cfo In Vancouver Fundamentals Explained

Table of Contents8 Simple Techniques For Vancouver Tax Accounting Company4 Simple Techniques For Tax Accountant In Vancouver, Bc8 Simple Techniques For Small Business Accountant VancouverLittle Known Facts About Virtual Cfo In Vancouver.

Because it's their task to stay up to date with tax obligation codes and also regulations, they'll have the ability to encourage you on exactly how much cash your business needs to place aside so there aren't any type of shocks. Prior to you go crazy an audit isn't constantly poor! The feared "internal revenue service audit" takes place when an organization isn't submitting their taxes appropriately.

When it concerns planning for any kind of audit, your accountant can be your finest good friend due to the fact that they'll save you lots of time preparing for the audit. To stop your organization from obtaining "the poor audit", here are some pointers to follow: Submit as well as pay your tax obligations on schedule Don't improperly (or neglect to) data organization sales as well as invoices Do not report individual costs as overhead Maintain exact company records Know your particular business tax reporting responsibilities Recommended analysis: The 8 Most Common Tax Obligation Audit Activates Quick, Books After reviewing the standard accounting as well as bookkeeping services, you're probably questioning whether it's something you can handle on your own or require to hand off to a specialist.

Will you need to prepare once a week or month-to-month economic records or just quarterly as well as yearly reports? One more indicate think about is financial expertise. Exists somebody in your workplace that is certified to manage vital audit and also bookkeeping solutions? If not, an accounting professional may be your safest bet.

Accounting professionals are rather flexible and can be paid per hour. Furthermore, if you do determine to outsource accountancy and also accounting solutions, you wouldn't be in charge of offering advantages like you would certainly for an internal employee. If you make a decision to work with an accounting professional or bookkeeper, below are a few pointers on locating the best one: Check recommendations and previous experience Make sure the prospect is enlightened in bookkeeping software program and also innovation See to it the candidate is fluent in accounting policies and treatments Examine that the candidate can plainly interact financial language in words you understand Ensure the prospect is sociable and not a robot Tiny service owners and also business owners usually outsource audit as well as accounting services.

The 5-Minute Rule for Vancouver Tax Accounting Company

We contrast the very best below: Wave vs. Zoho vs. Quick, Books Do not forget to download our Financial Terms Cheat Sheet, that includes essential accountancy and bookkeeping terms.:max_bytes(150000):strip_icc()/Accountingpolicies_color-6c5485e2b09541c697abd98d3094534c.png)

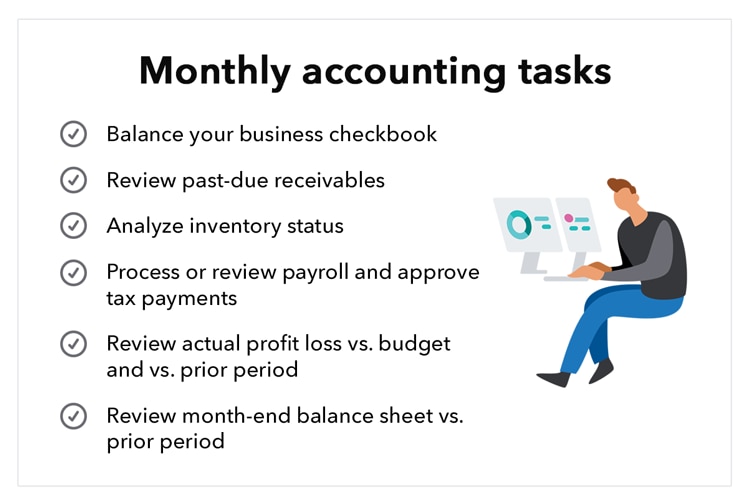

To be effective in this function, you must have previous experience with accounting and a panache for spotting numerical errors. Eventually, you will certainly provide us with exact quantitative information on monetary position, liquidity and capital of our organization, while guaranteeing we're certified with all tax guidelines. Take care of all accounting transactions Prepare spending plan projections Publish monetary statements in time Handle monthly, quarterly as well as yearly closings Reconcile accounts payable as well as receivable Ensure timely financial institution payments Compute taxes as well as prepare tax obligation returns Handle equilibrium sheets as well as profit/loss declarations Report on the company's economic wellness as well as liquidity Audit financial purchases and also documents Enhance financial information confidentiality and also conduct database back-ups when required Comply with monetary policies and also policies Work experience as an Accounting professional Outstanding expertise of audit regulations as well as procedures, including the Normally Accepted Audit Concepts (GAAP) Hands-on experience with bookkeeping software like Fresh, Books and Quick, Books Advanced MS Excel abilities consisting of small business tax preparation Vlookups as well as pivot tables Experience with general journal functions Strong interest to detail as well as good analytical abilities BSc in outsourced accounting services Accounting, Finance or appropriate level Added qualification (certified public accountant or CMA) is a plus What does an Accounting professional do? An Accountant takes care of all financial matters within a company, like maintaining as well as analyzing financial documents - small business accountant Vancouver.

The obligations of an Accounting professional can be rather substantial, from bookkeeping financial documents and also conducting monetary audits to fixing up financial institution statements and computing tax obligations when filling up out annual returns. What makes an excellent Accounting professional?

Who does Accounting professional function with? Accounting professionals work with magnate in small firms or with managers in big companies to make certain the top quality of their monetary records. Accounting professionals might likewise team up with private group leaders to obtain and also audit financial documents throughout the year.

Fascination About Pivot Advantage Accounting And Advisory Inc. In Vancouver

The term audit is very usual, particularly during tax obligation season. Before we dive into the value of accounting in company, allow's cover the essentials what is bookkeeping? Bookkeeping refers to the organized and in-depth recording of monetary deals of a business. There are lots of types, from making up small companies, federal government, forensic, and also monitoring audit, to representing corporations.

Regulations and also guidelines vary from state to state, however proper accounting systems as well as processes will certainly aid you ensure legal compliance when it pertains to your business (CFO company Vancouver). The accounting function will certainly guarantee that responsibilities such as sales tax obligation, BARREL, income tax, and pension plan funds, to call a couple of, are properly resolved.

Service patterns as well as projections are based on historical monetary information to keep your operations rewarding. Businesses are called for to submit their economic statements with the Registrar of Business.

Some Known Details About Virtual Cfo In Vancouver

:max_bytes(150000):strip_icc()/accounting-cycle-4202225-55b4e93d325f490aa6e7bd3a13fd1304.jpg)

Report this wiki page